3 Ways Active Traders Can Profit Using Social Media Analytics

One of the big questions we often hear from active stock and ETF traders is, “How can I use social media analytics to increase my profits?”

Here are three techniques you can use:

Technique #1: Event-Driven News

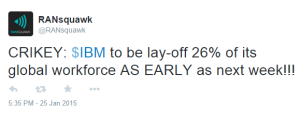

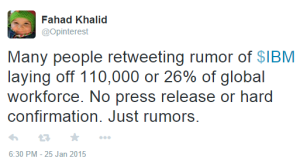

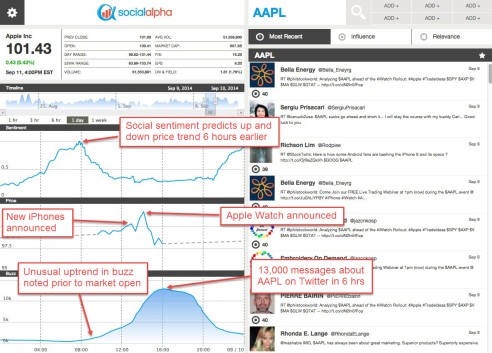

Major social media platforms like Twitter are now significantly larger and faster than traditional financial news sources.

You can get ahead of the news and make big profits using social media analytics to identify and trade market events ahead of the crowd.

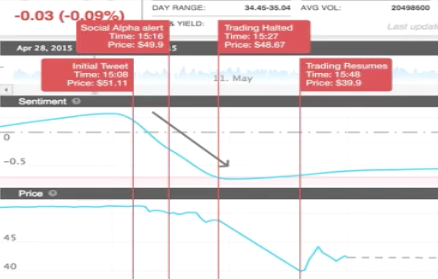

A classic situation was Twitter’s “earnings leak” on April 28, 2015. Social analytics allowed traders to enter short trades before trading was halted.

There are billions of social media messages per day related to stocks and ETFs. Finding these market-moving messages is like finding a needle in 1,000 haystacks.

To achieve this, you need an advanced social analytics platform designed to isolate high magnitude trade-worthy messages from the mass of social media data, and deliver them to you for your trading decisions.

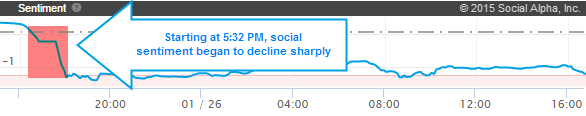

Technique #2: Sentiment Trends

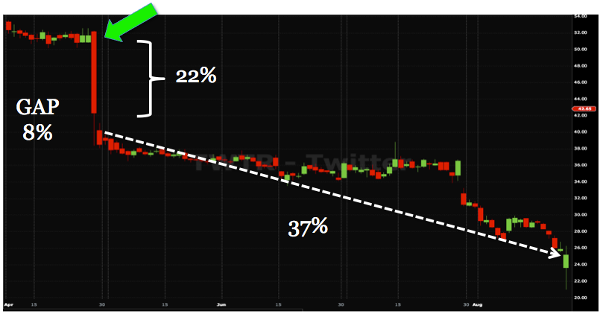

“The trend is your friend” is as true for social media analytics as it is in traditional technical price analysis.

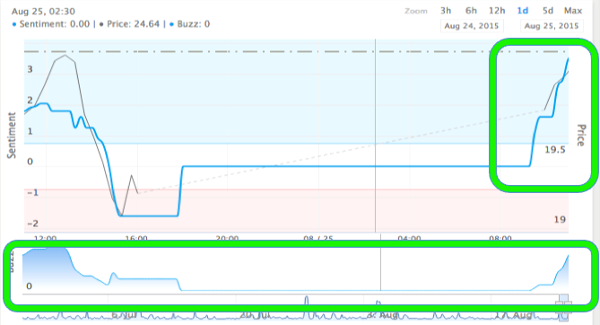

When the longer-term trend of social sentiment lines up with a price trend, this tends to support a trend continuation. Take a look at this example with Agnico Eagle Mines (AEM):

Similarly, if price makes a counter-trend move and social sentiment does not follow, you can use this information to “buy the dip” (uptrend) or “sell the peak” (downtrend).

Trading social sentiment trends requires social analytics that can be aggregated across different time periods to compare against intraday, daily and weekly price trends.

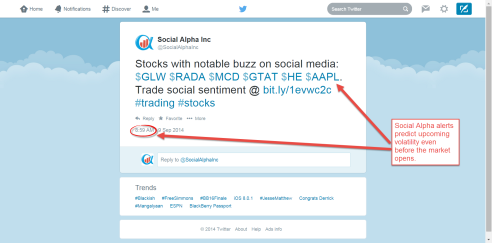

Technique #3: Reversals

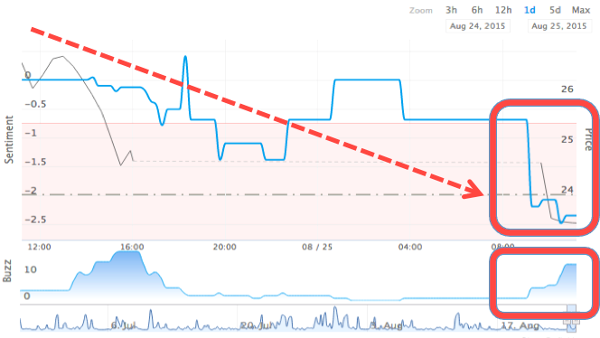

In most markets, significant price reversals tend to occur in conjunction with high volatility and large volume. Social media is similar in this respect.

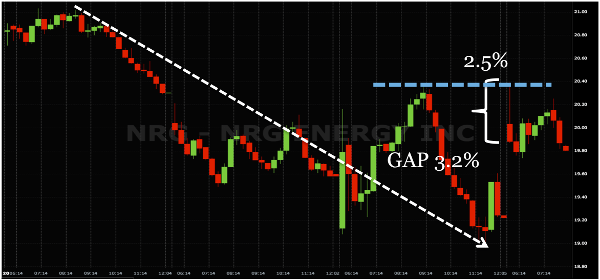

During periods of reversal, social chatter (aka “buzz”) tends to increase. The spread between bullish and bearish opinions widens as the crowd diverges on the future direction of the stock or ETF. An example of social media analytics signaling a potential price bottom is shown below with NRG Energy.

The most powerful reversals tend to occur in conjunction with surprise events, such as a merger, operational failure (e.g. oil spill) or regulatory approval (e.g. successful drug trial).

To help identify price reversals, your social analytics platform should have social volume, momentum and volatility indicators similar to traditional share volume, Relative Strength (RSI) and Average True Range (ATR).

Learn More

To learn more and get hands-on access please request a FREE TRIAL of our social analytics dashboard and real time alerts.